Discussion points and feedback:

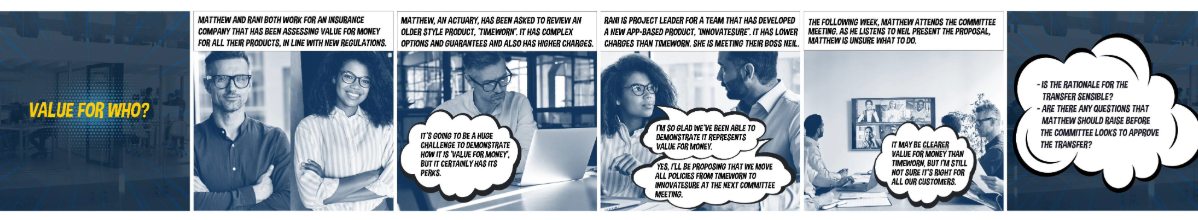

Is the rationale for the transfer sensible?

The rationale for the transfer appears to be to avoid a complex value for money assessment, rather than thinking about the outcomes for policyholders. Without carrying out such an assessment on the product, it’s difficult to demonstrate that the new product provides good outcomes compared to the first, particularly as options or guarantees might be particularly valuable to (some) groups of policyholders. The Integrity principle of the Actuaries’ Code (the Code) where it states that “Members must act honestly and with integrity” and the Competence and Care principle “Members must carry out work competently and with care” are particularly relevant in this scenario.

Are there any questions that should be asked before the committee consider approving the transfer?

The Communications principle of the Code states that “Members must communicate appropriately”, with the principle amplification stating that “Members must take reasonable steps to ensure that any communication for which they are responsible or in which they have a significant involvement is accurate, not misleading, and contains an appropriate level of information.” If the quantifiable assessment is proving challenging, alternative qualitative assessments might be explored, this could include debate, reviewing take-up rates of the option and policyholder interactions, such as communication out and in, e.g. complaints.

The Compliance principle will also be relevant “Members must comply with all relevant legal, regulatory and professional requirements”, the actuaries should consider whether other regulatory requirements are also relevant to the decision and whether there is a legal basis for moving the policyholders into a new product. It may be appropriate to seek input from legal professionals to comply with the amplification of the Competence and Care principle “Members must consider whether input from other professionals or specialists is necessary to assure the relevance and quality of work and, where necessary, either seek it themselves or advise the user to do so, as appropriate.”

If Matthew has doubts about the proposed course of action, he has a duty to voice these, for example to highlight that the loss of options or guarantees may prove disadvantageous to some or all holders of the legacy product, which may result in non-compliance with the new regulations.

What other actions could the firm consider?

The Impartiality principle which states that “Members must take reasonable steps to ensure that they are aware of any relevant interests that might create a conflict” and the Communication principle amplification where “Members must take reasonable steps to ensure that any communication for which they are responsible or in which they have a significant involvement is accurate, not misleading, and contains an appropriate level of information” come into play here.

Alternative solutions might include allowing policyholders to “opt in” or “opt out” of the transfer, continuing to honour the options or guarantees for transferring policies, or to work through the challenges to demonstrate value for money in the legacy product (taking any required action off the back of the assessment). A full assessment may confirm that the transfer is in the best interests of many (or all) policyholders due to the benefits of a modern platform and lower fees.