Professional Skills Training: Integrity

Keeping the Faith

A DEI-related scenario regarding the difficult decisions and diverse needs of team members requiring time off and flexible working during busy work periods.

I hate to gossip

Office banter and general socialising can be both good for company morale and promote a real sense of bonding and enjoyment about working together in an office. But where is the line between idle gossip with no malicious intent and breaking the Actuaries’ Code?

Could this be you?

Natalie, a qualified pensions actuary, goes to see her boss, Dominic, after she has her laptop bag stolen from a cafe. She is not too concerned about the laptop since it’s all protected and backed up but slowly gets to realise that’s not the main issue!

Value for who? (storyboard)

A firm is assessing their product range following new regulations that require them to demonstrate value for money. They have a modern product which they wish to move legacy customers in to, but are they doing it for the right reasons?

Value for who? (storyboard)

Growthbusters

nsodex insurance company is experiencing reduced sales and market share in a competitive lifetime mortgage market. At Insodex, the Sales & Marketing division deals with distribution of the product, and with key relationships with financial advisors.

The Young & the Restless

Andy, a new boss, has come into a team, fresh-faced and eager to make some changes. But Peter who is the most experienced member of their team isn’t too keen on the plan, or on the fact that their former junior is now his boss!

Pilot without licence

A large insurance company has commissioned a behavioural economics review of policyholder letters, which has been inspired by the Regulator’s ‘Consumer Duty’ requirements.

Gossip Con (Storyboard)

Two colleagues meet at a conference. One is keen to gossip and make remarks about two of the speakers, while the other grows increasingly uncomfortable.

Wordsmith

Actuarial consultancy staff “borrowing” words from a client report, so not respecting confidentiality and copyright standards.

Pick-n-Mix

Career progression is often reliant on a metric - some form of measurement that assesses performance, undertaken during a job interview, or perhaps an appraisal. But a single metric can hide a lot of information, and it may not always be fair. This case study considers three individuals who have applied for a position in a company: one is a neurotypical individual who is an all-rounder, and the other two individuals are neurodivergent.. The hiring managers discussing the applicants’ performance, may or may not be exhibiting unconscious bias.

Just being honest

Lucy and Justin are two junior part-qualified actuaries who are about to have meetings to have work peer reviewed. Glenn and Kim, the reviewers, have ways of communicating that may well be considered ‘unprofessional’, but both give what they consider to be just ‘honest feedback’.

Just being honest

Lying A.I.s

The year is 2026. 1-GEN is one of the top three general insurers in the UK and top 10 in the EU. Like all other GI companies, 1-GEN uses AI (Artificial Intelligence) systems to dynamically price and underwrite policy applications and employ optimisation techniques to maximise profit within the allocated risk budget across policy lines.

Simon, an experienced Actuary and Data Scientist, has been doing some tail risk analysis on the contents lines and has done a ‘deep dive’ into the data that drives the systems. He finds inconsistencies but it doesn’t look like it’s a glitch in the system, rather an issue in how the AI has been programmed to maximise profits. He raises his concerns with Veronique who is the statutory reporting actuary. Veronique wonders whether, given that it could be a company-wide or industry-wide issue, should she report it immediately or give herself more thinking time and raise it once she better understands the scale of the problem.

Making the Cut

This scenario depicts how the framing of questions and personal biases of interviewers can impact the interviews e.g. biases against gender, age, race, mental health. The two main characters (Claire and Michelle) are conducting an interview process and it becomes clear that they are not entirely happy with any of the candidates, but feel they need to make a decision rather than go through the process again, due to other work pressures.

Temperatures Rising

This scenario features a discussion about a risk framework to handle climate change within an insurance company. This gets out of hand, with neither of two extreme points of view (expressed by Lee and Serena) providing a worthwhile solution to exasperated Team Leader Zara. Both Lee and Serena are passionate about their personal opinions on the subject and how it relates to Actuarial work. Each think the other is being totally unrealistic. This scenario focusses on heated opinion driven discussions rather than climate change.

Temperatures Rising

How Urgent is Urgent?

Richard is training Amy in the process of setting assumptions. Amy is keen to make an impact and has been inspired by some of the materials she has been reading about climate and wants to incorporate climate into the assumption setting process. Richard wants a data driven exercise and explains how the process is well established and disputes the statistical validity of Amy’s proposal.

How Urgent is Urgent?

Diverse Minds

Sam, an actuary, is having an off day when his day starts badly with travel disruption and meetings are re-arranged at short notice. Allie is more sympathetic than other colleagues. However, the following day we see a different side to Sam when things have gone more smoothly. Allie values Sam’s amazing attention to detail and had asked Sam to check a report before it is submitted to a client. Sam, true to form, spots an error which was missed by his actuarial colleagues.

Diverse Minds

The New World

Elise and Jeremy are actuaries in their 30s. Ex-colleagues and good friends, they stayed in contact via regular ‘Zoom’ catch ups when Jeremy moved to a different company three months ago. While Jeremy now works from home, Elise now does some days in the office each week. Each of them is having to adjust to new work patterns with the distinction between; what is work time and what is social time, becoming ever more blurred.

The New World

Pride or Prejudice

Four colleagues discuss the recruitment of new members to an internal working team. But the line between appropriate comments and inappropriate comments seem very blurred, sometimes crossing the line completely.

Pride or Prejudice

The Pitch

An insurance company has invited an actuarial consultancy to a meeting to pitch for a climate change and sustainability project. Through a lack of preparation, in-built biases and preconceptions by the consultancy staff, the meeting goes from bad to worse.

The Pitch

Heated Discussion

Kit and Anthony, both actuaries, have been invited to participate in a "Climate Change Special" TV production in the context of a "Risk Alert" published by the IFoA on "Climate Related Risks". Although representing the IFoA, it becomes less clear during the interview whether they are presenting a view from the IFoA, their employers or their own personal views. Faced with a seasoned interviewer who has done her research on views represented by each of the participants on previous occasions - let's see if the interview goes according to plan...

Heated Discussion

The Vigilante

Keith, an actuary, sees a post on social media which enrages him. He’s deeply passionate about the impact that COVID-19 has had on our everyday lives and loved ones, and attempts to correct the comments as he feels ‘it’s the right thing to do’, but lets his emotions run away with him. Others get involved in the online exchange and a journalist picks up on the thread and uses the comments that Keith has posted.

The Vigilante

Three Days

Clyde has been with the company for four months and has just been added to the client team for a large, important client, Massomax, headed by team-leader Danica. To date Clyde has also been working for smaller clients which earn less in fees, including TiniMicro, with team-leader Susan. Clyde has a statutory deadline approaching for TiniMicro and there will be a fine if he misses it. However, Danica urges Clyde to prioritise work for their bigger paying client Massomax, hinting that prioritising her work will be good for Clyde’s career progression. See what happens when Clyde attempts to resolve the competing pressures.

Too Close for Comfort

Marcus and Alison are both actuaries and a married couple work at competing firms. Here they describe, via phone calls and video diaries, the pitfalls of working from home, sharing a makeshift office and having to manage confidential processes in a confined space. Confidential information on screens and Marcus’s inquisitive mother make balancing work and two young daughters at home much more challenging than necessary.

Do IT Right

Charles works for an insurer who has licensed a platform and set of models from an actuarial software provider, with an annual licence fee. Charles decides to build their own bespoke modelling system, and populate it using the calculation methodology from the software provider’s models. After all, that's what everyone does when new technology comes along - take the best bits and improve on it, right?

Do IT Right

Inside the Black Box

Black Box Insurance sets up Project Polar with a multidisciplinary team of actuaries and data scientists to implement a pilot using AI technology for insurance renewal pricing – quicker, faster, less human interaction for competitive advantage. Watch how this unfolds and issues that arise when the Board decides to skip the pilot and go straight to full implementation of the technology.

Inside the Black Box

Time off

Andrew, a partner at a small actuarial consultancy, is keen to win a new property modelling project. A tender proposal is drawn up citing Kieran as the firm's properly modelling expert, despite Kieran making it clear that he is no expert in this area and in any case is about to go off on 6 months' paternity leave. Nonetheless, the proposal is submitted and the consultancy is awarded the contract - what now?

Time off

All in a Day’s Work

Andrew, Chief Actuary at ILAC Singapore is in the middle of filming a promotional video as part of a recruitment drive, when Pui Yee, a recent recruit, lets slip she is about to download “Actuarify” software, a comprehensive reinsurance comparison tool from her previous company. Andrew abandons the promotional shoot and steps in with some advice for Pui Yee, before putting her professional judgement to the test.

All in a Day’s Work

Blog

Peter works within a General Insurance business of a large composite insurer. He has a wide-ranging role which gives him insight into various confidential aspects of the business. In his spare time, he writes a blog on various topics regarding motoring under the pseudonym of “Calculus Pete” in an attempt to keep his identity hidden. One day while browsing, Peter's colleague Rick, an actuarial trainee, who works alongside Peter becomes suspicious at the content and level of detail in a blog he comes across

Blog

Contribution Conundrum

Frank, a newly appointed Scheme Actuary, meets his clients who have an exciting business plan in place to grow their business and envisage the deficit in the pension scheme being paid off in 2 years’ time. Frank has different views to those of his predecessor and his clients are not happy when he shares this with them.

Contribution Conundrum

Rocky

Jolyon, (one of our trusted corporate training duo 'Clive and Jolyon') joins forces with Lewis Price, a pricing actuary to form the team 'The Invincibles' representing their client 'Hook Insurance' in tight negotiations with 'The Challengers' on behalf of brokers 'X-Change'. Each team is out to get the best price. Clive leads us through the action with a boxing themed analogy.

Rocky

Brave New World

Two young entrepreneurs, Mac and Keevi, have set up a start-up app-based insurance company, Treasure, which is due to launch in a few months (when their regulatory licences come through). They want to offer a wide range of insurance products: home, motor, health, life, pet, travel, using the latest technology to price policies and market product offerings to consumers. While waiting to discuss their plans with the regulator, they get an unexpected challenge from a voice from the past!

Brave New World

That was my idea too!

Peter, a junior actuary in the actuarial department of an insurance company, has recently moved to the Asset and Liability Modelling (ALM) team. They are a very close team and Peter is having some difficulty settling in and feeling part of the team. Peter comes up with an innovative idea around managing the firm’s currency risk and shares this with his boss, Fern. The idea then gets presented to the Asset Liability Committee but it has come across as Fern’s and the others’ idea.

That was my idea too!

Changing Jobs

Clive and Jolyon, our trusted training consultants eavesdrop on Eric, an actuary with specialist knowledge in Liability as he chats to his colleague Sarah, a trainee lawyer. Eric has an exciting new job offer based on the knowledge and expertise gained at his current employer Bloom Inc, a market leader in Eric's specialist field, however he has a few concerns around what information and skills gained at Bloom Inc can be used/shared with his new employer GT Insurance. For example is it okay to retain copies of past work? Clive and Jolyon explore the issues.

Changing JobsInteractive Case Studies 2023

Mindless Acts

This case study has been created to tease out, what is on the surface, straight forward interactions with colleagues. Do you consider the consequences of your reaction when involved in these types of conversations?

Mindless ActsMini Case Studies

Sneak Peek

Emma, an actuary, is undergoing online mandatory internal training, culminating in a short multiple-choice quiz (MCQ). All staff must undergo the training and ’pass’ the quiz, otherwise they will have to undergo a refresher course. Emma completes the training and as she’s about to take the MCQ test, she receives an email notification from Petra, a colleague, who’s completed the training successfully and is sharing the answers to the MCQs.

Sneak Peek

Rounding up

Sian started doing some e-learning modules and noticed that the quizzes appeared to be based on assessment questions that she had previously completed last year. As she referred to some notes from the previous year, she completed the module in a third of the time but recorded the full time allocated to complete the modules. Is there anything wrong with Sian counting this work-based learning towards the mandatory CPD requirements?

Rounding up

Answer me this

Bianca, an actuary, is finalising some pricing work and decides to call her colleague to discuss as she has some concerns that the results are not right for the consumers. Her colleague Tim reminded Bianca that the client is only paying for technical actuarial input, but Bianca is concerned that if they don’t call out the risks and alternatives that it will look like an endorsement. Can Bianca consider the limited scope without considering a wider duty of care?

Answer me this

Time and Time Again

This scenario is based on the Chair of a working party trying to schedule a regular meeting time that is not convenient for participants in different time zones.

Time and Time Again

A Conflict of Advice

Amy has just been recruited by MultiBig plc as the in-house actuary to advise on MultiBig’s employee pension scheme. Leonard, the Chief Operations Officer at MultiBig plc, asks Amy to provide commentary and a second opinion on a number of matters in relation to the pension scheme. Following the meeting, Amy prepares a report with some discussion points for the Scheme’s Trustee Board. Amy issues the report to Leonard, who is also the chair of the Trustee Board, for discussion at the forthcoming meeting. Priya, an external consultant, and Scheme Actuary to MultiBig’s pension scheme, is preparing her usual report for the Trustee Board meeting. At the Trustee meeting, Leonard presents Amy’s findings. Some of the points raised contradict the points in Priya’s report.

A Conflict of Advice

Hedging your bets

The asset management team of Lifeco checked and agreed a particular asset to be purchased to match a specific liability. However, a few days later, they realise they have used out of date data to determine the asset needed to match the liabilities. As luck would have it, they have made some additional profit that wouldn’t have been made if they had used the correct data.

Joking Aside!

Theo and Karl are at a climate change conference where Karl posts a joke anonymously in the chat forum for the webinar/session and gets lots of likes and replies. At another session of the conference the next day, Theo messages Karl privately commenting on the presenter and then an anonymous post appears on the conference chat forum. Theo is concerned about the comment raised and wonders if it was Karl who posted it.

Joking Aside!

Profit before Probity

Luke, a pricing actuary, has been asked by his boss, the Commercial Director of a large insurance firm, to analyse and implement new data courses which will allow greater profit optimisation to take place when pricing insurance policies. In carrying out the analysis Luke has some concerns in relation to customer fairness considerations.

Profit before Probity

To Pool or not to Pool

Julia is a junior member of an actuarial pricing team, reporting to the senior actuary about the latest pricing model, which implements machine learning algorithms using data from Internet of Things (IoT) devices. Another actuary observes that the pricing is so granular and contradicts the principle of pooling risks, which is the foundation of insurance.

To Pool or not to Pool

Do Two Wrongs make a Right?

You notice that the spreadsheet you are working on has an error but that another error reverses the first error so there is no net impact on results. Do you keep quiet or speak up?

Do Two Wrongs make a Right?

Don’t Mask, Don’t Get

Sakura is concerned that a colleague is potentially putting others at risk having breached the current Covid guidelines - what should she do?

No Harm Done?

Your friend Jamal an actuary, currently furloughed by his employer, an insurance company, tells you he has been asked to do a bit of work to help out the team in a busy period. Is it an issue if he agrees to do the work?

Partner in a Pickle

Ellen an actuary is being made a partner in her firm and on the advice of her friends, signs a confidentiality agreement having failed to source any legal advice.

Partner in a Pickle

Spotting an Error

Michael is asked to sign a confidentiality agreement that prohibits him discussing the work he is undertaking with a third party. He notices an error that works in his company’s favour – should he speak up?

Whose money is it?

An actuary is compensated in cash for a business flight (paid by his employer) which has been delayed.

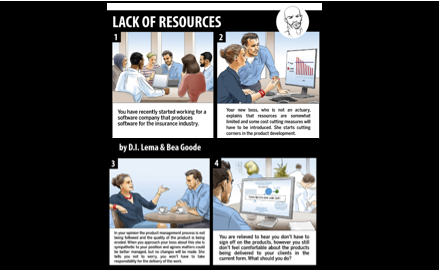

Lack of Resources

You raise concerns with your manager that the cost-cutting measures which have been introduced in the development of software products, which you are involved in, is affecting product quality. You are told not to worry as you won’t be responsible for product sign-off. What should you do?

Lack of Resources

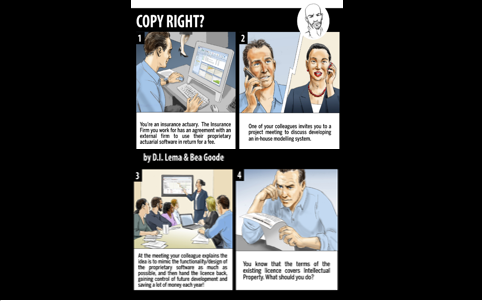

Copyright

A colleague puts forward a proposal at a meeting to mimic the proprietary actuarial software you are licensing from an external firm as a money saving exercise. What should you do?

Copyright

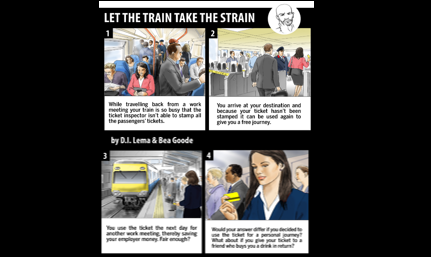

Let the Train take the Strain

While travelling back from a work meeting your train is so busy that the ticket inspector isn’t able to stamp all the passengers’ tickets. This means you are able to use it again the next day and save costs to your employer, but should you?

Let the Train take the Strain

News Travels Fast

You have become party to some confidential industry information relating to product development at a particular firm and relay this to your boss who happens to be a friend of the Senior Actuary at the firm in question. What should your boss do?

News Travels Fast

Nobody Needs to Know

You complete an application form for a promotion at the firm you have worked at for the last 10 years but fail to disclose a criminal conviction from 5 years ago, after all 5 years is a long time. Is this acceptable?

Nobody Needs to Know

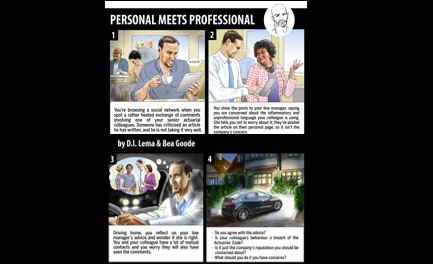

Personal meets Professional

You are concerned when you come across a heated exchange on a social network involving one of your senior actuarial colleagues and show the posts to your line manager, who doesn’t share your concerns as your colleague has posted on their personal page. Are you satisfied with her response?

Personal meets Professional

Time over time

You discover that you, and therefore likely the rest of your team, has been overpaid for overtime on your current project. You are aware that one team member is relying on the payment to meet essential commitments.

Time over time

Bad Form

You discover what you believe to be a mistake which has resulted in some pensioners being overpaid pensions for the last decade but when you mention it to the Scheme Actuary, they are not inclined to rectify the error and to simply adjust pay-outs going forward.

Bad Form

Conference Highs and Lows

An eventful celebration has unforeseen consequences!

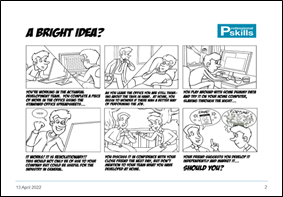

A Bright Idea?

You've come up with a brilliant idea how to improve a work task whilst reflecting at home on the task in hand. It's revolutionary and potentially lucrative - but are you free to market your idea?

All Above Board

You discover that a fellow trustee of a charitable foundation has two children at a school which is a recipient of an annual donation from the foundation. What action, if any, should you take?

All Above Board

Overstating the Facts

You are a partner at a consultancy firm and learn that the marketing department has begun advertising the firm’s use of a new set of software which will bring advantages for your clients. However, this seems premature to you as users within the firm have yet to be trained. What should you do?

Overstating the Facts