Professional Skills Training: Impartiality

Ethical to the Corps (storyboard)

Sam has been instructed by the company’s Finance Director to prepare a counter-proposal to the Scheme Actuary’s assumptions for the valuation but Sam is concerned that the instruction is biased in favour of restricting the counter-proposal only to arguments that will reduce the level of prudence to achieve the desired outcome for the company, which could compromise Sam’s integrity and impartiality.

Making the Cut

This scenario depicts how the framing of questions and personal biases of interviewers can impact the interviews e.g. biases against gender, age, race, mental health. The two main characters (Claire and Michelle) are conducting an interview process and it becomes clear that they are not entirely happy with any of the candidates, but feel they need to make a decision rather than go through the process again, due to other work pressures.

Temperatures Rising

This scenario features a discussion about a risk framework to handle climate change within an insurance company. This gets out of hand, with neither of two extreme points of view (expressed by Lee and Serena) providing a worthwhile solution to exasperated Team Leader Zara. Both Lee and Serena are passionate about their personal opinions on the subject and how it relates to Actuarial work. Each think the other is being totally unrealistic. This scenario focusses on heated opinion driven discussions rather than climate change.

A Merging of Minds?

This scenario involves a conflict between two actuaries, when ‘advising’ the trustees on investment strategy, which comes to a head at a Trustee board meeting. One of the actuaries didn’t set out to ‘advise’ and initially thought they were just explaining actuarial concepts in a generic context.

Next Level

This scene is based on a pitch for a new scheme actuary appointment but concerns about the possible perception of lack of independence/cross-selling of other services.

Paul’s boss tells him that he's been chosen to pitch for a new scheme actuary appointment. He has a few small scheme appointments but this new one would be a big scheme of a large company, which is obviously very exciting. In doing his research Paul finds that a new independent trustee was appointed a few months back who is employed by a separate Trustee company within his employer's group. He looks at the client list of his employer and finds that for over half the scheme actuary appointments his employer's Trustee arm are the independent trustee. He is concerned about the possible perception of lack of independence this could cause and speaks to his boss. His boss tells him not to concern himself and that "there's no need to rock the boat"!

Funnels of Doubt

Mark, Emma, and Aileen are all actuaries working for a small insurance company. Mark and Emma worry about the effect of climate change on the planet and what changes they will see in their lifetimes. Aileen, their boss, is neutral on climate change personally, but sees it as yet another issue she has to consider when overseeing projects and running a busy actuarial team. Mark and Emma have been working on some scenarios for how the firm’s insurance business might be affected by climate change over the next 30years. Initially somewhat daunted by how to do the work, through their own research and some helpful external consultancy input, they have the results written up and ready to take to senior managers and the Board.

The New World

Elise and Jeremy are actuaries in their 30s. Ex-colleagues and good friends, they stayed in contact via regular ‘Zoom’ catch ups when Jeremy moved to a different company three months ago. While Jeremy now works from home, Elise now does some days in the office each week. Each of them is having to adjust to new work patterns with the distinction between; what is work time and what is social time, becoming ever more blurred.

Boss’s Best Buddy

Michael, a graduate trainee Actuary, finds himself the talk of the office when his colleagues notice how much time he’s been spending with their manager Sofia, and how much special attention he may be receiving as a result. Entirely harmless from his perspective. But as yearly review time rolls around, his colleagues can’t help but raise the question of whether unfair favouritism may be at play?

Too Close for Comfort

Marcus and Alison are both actuaries and a married couple work at competing firms. Here they describe, via phone calls and video diaries, the pitfalls of working from home, sharing a makeshift office and having to manage confidential processes in a confined space. Confidential information on screens and Marcus’s inquisitive mother make balancing work and two young daughters at home much more challenging than necessary.

A Level Playing Field

The Chief Actuary is ‘pushing’ his friend’s product – or is that just Martine’s ‘perception’ of the situation? She ‘thinks’ but she doesn’t ‘know’. It could be a good product but she is being put under intense pressure to ‘get it sorted’, plus she has so many other things to sort out on her other projects.

Do IT Right

Charles works for an insurer who has licensed a platform and set of models from an actuarial software provider, with an annual licence fee. Charles decides to build their own bespoke modelling system, and populate it using the calculation methodology from the software provider’s models. After all, that's what everyone does when new technology comes along - take the best bits and improve on it, right?

All in a Day’s Work

Andrew, Chief Actuary at ILAC Singapore is in the middle of filming a promotional video as part of a recruitment drive, when Pui Yee, a recent recruit, lets slip she is about to download “Actuarify” software, a comprehensive reinsurance comparison tool from her previous company. Andrew abandons the promotional shoot and steps in with some advice for Pui Yee, before putting her professional judgement to the test.

Blog

Peter works within a General Insurance business of a large composite insurer. He has a wide-ranging role which gives him insight into various confidential aspects of the business. In his spare time, he writes a blog on various topics regarding motoring under the pseudonym of “Calculus Pete” in an attempt to keep his identity hidden. One day while browsing, Peter's colleague Rick, an actuarial trainee, who works alongside Peter becomes suspicious at the content and level of detail in a blog he comes across

Blog

Contribution Conundrum

Frank, a newly appointed Scheme Actuary, meets his clients who have an exciting business plan in place to grow their business and envisage the deficit in the pension scheme being paid off in 2 years’ time. Frank has different views to those of his predecessor and his clients are not happy when he shares this with them.

Contribution Conundrum

Head to Head

Chief Reserving Actuary, Peter, presents a range of reserves at an annual meeting. After being challenged he suggests a narrower range. However the Finance Director, Stephanie, is clearly not happy and seeks advice from an actuary friend. Armed with this information, at a subsequent meeting she then proposes setting the reserves at a much lower figure which is even below the bottom end of Peter's earlier recommendations and puts pressure on the Board to swiftly agree. Let's see how Peter reacts.

Head to Head

Rocky

Jolyon, (one of our trusted corporate training duo 'Clive and Jolyon') joins forces with Lewis Price, a pricing actuary to form the team 'The Invincibles' representing their client 'Hook Insurance' in tight negotiations with 'The Challengers' on behalf of brokers 'X-Change'. Each team is out to get the best price. Clive leads us through the action with a boxing themed analogy.

Rocky

Challenging Advice

The 'Yes We Care' Defined Benefit Pension Scheme is carrying out its triennial valuation. The trustees of the Scheme have appointed Sheila as scheme actuary. Mark, the firm’s investment actuary, uses the firm’s economic scenario generator (ESG) to develop expected returns on the trustees’ portfolio of assets, including a probability range. Mark also gets input from the scheme’s investment consultants “We Invest You Benefit’. Mark, who used a different but equally tried and tested ESG, arrived at a similar ballpark figure for the discount rate for the triennial valuation which is about 1.5% down on the previous valuation. See how the trustees react.

Challenging Advice

Factor Fiction

The 'Widgets-R-Us' Pension Scheme, closed to new employees last year, whilst still fragile, continues to pay benefits to members reaching 65. The Chairman of the Trustees and Financial Director, George, explains an option within the Scheme which enables retiring members to convert part of their pension into cash, to the Chief Executive Officer, Bridget. Sophie, the Scheme Actuary, is put in a difficult position at a members’ strategy meeting later that day, when George enthusiastically invites her to present the benefits of commuting their pensions.

Factor Fiction

Singaporean Life

Andrew, an IFoA qualified actuary, returns to Singapore having been promoted to a senior role in an international Life Assurance company following a 2 year stint in their Head Office in Geneva, Switzerland. A few months into the role Andrew is facing some professional dilemmas and is feeling rather isolated in this international, multidisciplinary environment.

Singaporean Life

Look before you Leap

Mike and Samantha are experienced actuaries and co-founders of their two person actuarial consultancy. On the strength of winning a lucrative contract with Gertax Insurance, a small but successful company, Mike agreed with Samantha to invest significantly to update their IT equipment. However, upon re-reading the project definition ‘terms of reference’ document Mike is dismayed to see that it is not as robust as he would wish. Difficult discussions with the client’s project sponsor follow and Mike is left in no doubt that he will need to deliver or face the consequences.

Look before you Leap

A Principled Approach or the Easy Option?

Serena, a recently qualified actuary, puts a proposal to Victoria her boss, in respect of maturity pay-outs for a closed group of policyholders, for which the calculations rely on the, soon to be abolished, statutory regime in the UK. Serena’s simplified calculations would be sustainable and, subject to estimated future expense savings, affordable. Due to pressure from the Board to constrain budgets Victoria suggests Serena should change the assumptions to come up with a narrower range of outcomes and a good rationale that any underpayments are not material. Choose your own ending: i) Serena maintains her ground, ii) Serena gives in to pressure.

Trouble at the Top

Rowan is a junior actuary at an actuarial firm which provides both pensions administration services and actuarial advice to companies. Their clients include Rummidge Auto Parts which has a fairly small defined benefit pension scheme with about a hundred members and is now closed to new entrants. Rummidge Auto Parts has a management board although, in practice, the Chief Executive Officer (CEO) and the Finance Director (FD) make the important decisions. The defined benefit pension scheme also has a trustee board of which the CEO and FD are both members. Rowan is approached by the administrator for the Rummidge Auto Parts pension scheme, who is surprised to have received two large transfer value requests from both the CEO and the FD. Rowan raises his concerns about the transfer requests with Amit, the (very experienced) pension scheme actuary.

Trouble at the TopMini Case Studies

A Conflict of Advice

Amy has just been recruited by MultiBig plc as the in-house actuary to advise on MultiBig’s employee pension scheme. Leonard, the Chief Operations Officer at MultiBig plc, asks Amy to provide commentary and a second opinion on a number of matters in relation to the pension scheme. Following the meeting, Amy prepares a report with some discussion points for the Scheme’s Trustee Board. Amy issues the report to Leonard, who is also the chair of the Trustee Board, for discussion at the forthcoming meeting. Priya, an external consultant, and Scheme Actuary to MultiBig’s pension scheme, is preparing her usual report for the Trustee Board meeting. At the Trustee meeting, Leonard presents Amy’s findings. Some of the points raised contradict the points in Priya’s report.

A Conflict of Advice

Profit before Probity

Luke, a pricing actuary, has been asked by his boss, the Commercial Director of a large insurance firm, to analyse and implement new data courses which will allow greater profit optimisation to take place when pricing insurance policies. In carrying out the analysis Luke has some concerns in relation to customer fairness considerations.

Profit before Probity

To Pool or not to Pool

Julia is a junior member of an actuarial pricing team, reporting to the senior actuary about the latest pricing model, which implements machine learning algorithms using data from Internet of Things (IoT) devices. Another actuary observes that the pricing is so granular and contradicts the principle of pooling risks, which is the foundation of insurance.

To Pool or not to Pool

Whose money is it?

An actuary is compensated in cash for a business flight (paid by his employer) which has been delayed.

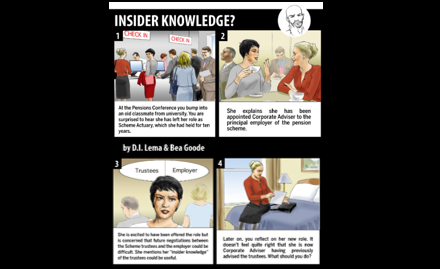

Insider Knowledge

You learn that an actuary friend is switching to the role of Corporate Adviser to the principal employer of a pension scheme, to which she had previously been the Scheme Actuary. This doesn’t feel right to you – what should you do?

Insider Knowledge

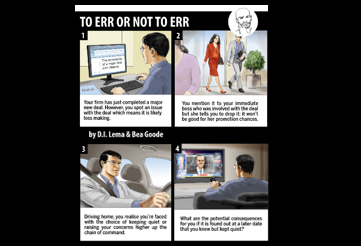

To err or not to err

You spot an error which means that a major new deal is likely loss making. You raise the issue with your boss who was involved in the deal who tells you to keep it quiet as it will impact negatively on them.

To err or not to err

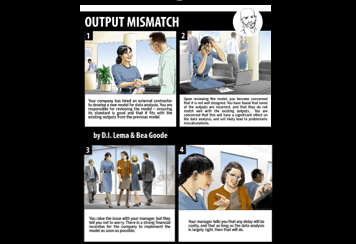

Output Mismatch

You are responsible for reviewing a new model for data analysis being developed for your company by an external contractor. You have some concerns that some of the outputs are incorrect but when you flag this to your manager he is more concerned about the financial implications of delayed implementation.

Output Mismatch

All Above Board

You discover that a fellow trustee of a charitable foundation has two children at a school which is a recipient of an annual donation from the foundation. What action, if any, should you take?

All Above Board

Blurred Lines

You are faced with the dilemma of raising a delicate matter with your boss who you know can be a little indiscreet at times.

Microsites

The Many Faces of Bias

Interactive Microsite