Keeping the Faith

A DEI-related scenario regarding the difficult decisions and diverse needs of team members requiring time off and flexible working during busy work periods.

Keeping the Faith

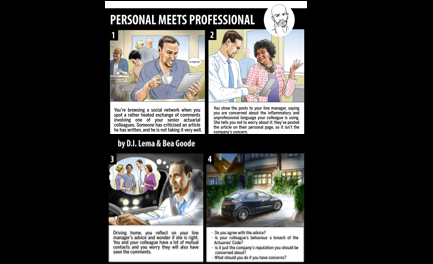

I hate to gossip

Office banter and general socialising can be both good for company morale and promote a real sense of bonding and enjoyment about working together in an office. But where is the line between idle gossip with no malicious intent and breaking the Actuaries’ Code?

I hate to gossip

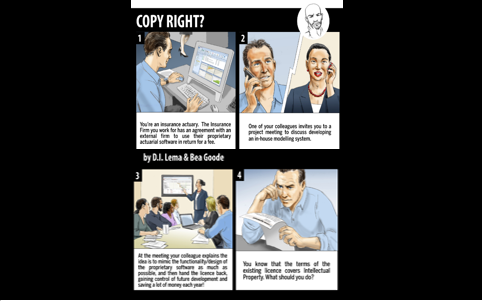

Wordsmith

Actuarial consultancy staff “borrowing” words from a client report, so not respecting confidentiality and copyright standards.

Wordsmith

Ethical to the Corps (storyboard)

Sam has been instructed by the company’s Finance Director to prepare a counter-proposal to the Scheme Actuary’s assumptions for the valuation but Sam is concerned that the instruction is biased in favour of restricting the counter-proposal only to arguments that will reduce the level of prudence to achieve the desired outcome for the company, which could compromise Sam’s integrity and impartiality.

Ethical to the Corps (storyboard)

Growthbusters

Insodex insurance company is experiencing reduced sales and market share in a competitive lifetime mortgage market. At Insodex, the Sales & Marketing division deals with distribution of the product, and with key relationships with financial advisors.

Growthbusters

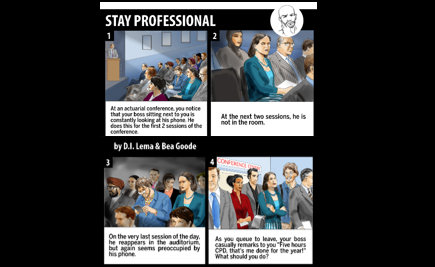

Gossip Con (Storyboard)

Two colleagues meet at a conference. One is keen to gossip and make remarks about two of the speakers, while the other grows increasingly uncomfortable.

Gossip Con (Storyboard)

Lying A.I.s

The year is 2026. 1-GEN is one of the top three general insurers in the UK and top 10 in the EU. Like all other GI companies, 1-GEN uses AI (Artificial Intelligence) systems to dynamically price and underwrite policy applications and employ optimisation techniques to maximise profit within the allocated risk budget across policy lines.

Simon, an experienced Actuary and Data Scientist, has been doing some tail risk analysis on the contents lines and has done a ‘deep dive’ into the data that drives the systems. He finds inconsistencies but it doesn’t look like it’s a glitch in the system, rather an issue in how the AI has been programmed to maximise profits. He raises his concerns with Veronique who is the statutory reporting actuary. Veronique wonders whether, given that it could be a company-wide or industry-wide issue, should she report it immediately or give herself more thinking time and raise it once she better understands the scale of the problem.

Making the Cut

This scenario depicts how the framing of questions and personal biases of interviewers can impact the interviews e.g. biases against gender, age, race, mental health. The two main characters (Claire and Michelle) are conducting an interview process and it becomes clear that they are not entirely happy with any of the candidates, but feel they need to make a decision rather than go through the process again, due to other work pressures.

Making the Cut

A Merging of Minds?

This scenario involves a conflict between two actuaries, when ‘advising’ the trustees on investment strategy, which comes to a head at a Trustee board meeting. One of the actuaries didn’t set out to ‘advise’ and initially thought they were just explaining actuarial concepts in a generic context.

Next Level

This scene is based on a pitch for a new scheme actuary appointment but concerns about the possible perception of lack of independence/cross-selling of other services.

Paul’s boss tells him that he's been chosen to pitch for a new scheme actuary appointment. He has a few small scheme appointments but this new one would be a big scheme of a large company, which is obviously very exciting. In doing his research Paul finds that a new independent trustee was appointed a few months back who is employed by a separate Trustee company within his employer's group. He looks at the client list of his employer and finds that for over half the scheme actuary appointments his employer's Trustee arm are the independent trustee. He is concerned about the possible perception of lack of independence this could cause and speaks to his boss. His boss tells him not to concern himself and that "there's no need to rock the boat"!

Diverse Minds

Sam, an actuary, is having an off day when his day starts badly with travel disruption and meetings are re-arranged at short notice. Allie is more sympathetic than other colleagues. However, the following day we see a different side to Sam when things have gone more smoothly. Allie values Sam’s amazing attention to detail and had asked Sam to check a report before it is submitted to a client. Sam, true to form, spots an error which was missed by his actuarial colleagues.

Diverse Minds

Boss’s Best Buddy

Michael, a graduate trainee Actuary, finds himself the talk of the office when his colleagues notice how much time he’s been spending with their manager Sofia, and how much special attention he may be receiving as a result. Entirely harmless from his perspective. But as yearly review time rolls around, his colleagues can’t help but raise the question of whether unfair favouritism may be at play?

Boss’s Best Buddy